● Meals & Entertainment

Meals and entertainment

Prior to the Tax Reform Act of 1986 “Travel and Entertainment” (T&E) was a well established business tax deduction. Since then IRC §274(n) limited some of the tax deductions, carving out “meals and entertainment” from “travel.” Prior to January 1, 2018 the tax deductions for Meals as well as for Entertainment were similar in many respects. Then as of January 1, 2018 entertainment is generally not a tax deduction. And meals consumed during a business meeting may or may not ultimately be determined to be a 50% tax deduction.

Generally most deductions for meals and entertainment expenses are limited to 50% of the original cost. In order to qualify as a deduction, all business meals and entertainment need to be substantiated. It makes no difference what other types of support you have for your business meals and entertainment; failure to meet the following can result in a disallowance of the tax deduction.

Starting January 2018, the Tax Cuts and Jobs Act (TCJA) eliminated the tax deduction for Entertainment and for food and beverages that are considered “entertainment.” Two exceptions: packaged food or beverage given to another person to be consumed at a later time. Tickets for admission to a place of entertainment if the taxpayer does not accompany the recipient. These are considered tax deductible “gifts” limited to $25 per year, per person rather than entertainment.

Taxpayers may generally deduct 50% of food and beverage expenses associated with operating their trade or business. The concept of a “substantial business discussion” has been eliminated under TCJA. Some examples of what are 50% deductible might include:

- snacks and beverages in the coffee room or employee kitchen.

- meals consumed while and employee of away on work travel.

Some examples of what are 100% deductible might include:

- Christmas parties primarily for your rank and file employees

- Annual picnics primarily for your rank and file employees

- Summer outings primarily for your rank and file employees

Pursuant to IRS notice 2018-76, taxpayers may deduct 50% of an otherwise allowable business meal expense if:

- The expense is an ordinary and necessary expense under §162(a) paid or incurred during the taxable year in carrying on any trade or business;

- The expense is not lavish or extravagant under the circumstances;

- The taxpayer, or an employee of the taxpayer, is present at the furnishing of the food or beverages;

- The food and beverages are provided to a current or potential business customer, client, consultant, or similar business contact; and

- In the case of food and beverages provided during or at an entertainment activity, the food and beverages are purchased separately from the entertainment, or the cost of the food and beverages is stated separately from the cost of the entertainment on one or more bills, invoices, or receipts. The entertainment disallowance rule may not be circumvented through inflating the amount charged for food and beverages.

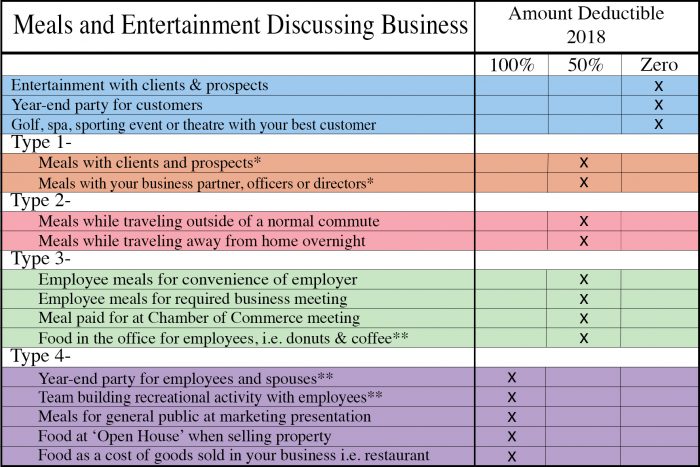

| Amount Deductible for Tax Year 2018 | |||

| Description |

100% |

50% |

Zero |

| Meals with clients and prospects |

X |

||

| Entertainment with clients and prospects |

X |

||

| Employee meals for convenience of employer |

X |

||

| Employee meals for required business meetings |

X |

||

| Meal served at Chamber of Commerce meetings |

X |

||

| Meals while traveling away from home overnight |

X |

||

| Year-end party for employees and spouses |

X |

||

| Golf outing for all employees and spouses |

X |

||

| Year-end party for customers |

X |

||

| Meals for general public at marketing presentations |

X |

||

| Team-building recreational event for all employees |

X |

||

| Golf, theater, or football game with your best customer |

X |

||

Substantiation requirements for business entertainment expenses

The entertainment expense must be reasonable and incurred in the “ordinary and necessary” course of your business and documented to meet IRS substantiation requirements.

- Cost and Receipt: The cost of each

entertainmentexpenditure must be recorded. When the cost is $75 or more, documentary evidence such as a receipt, voucher, or credit card charge copy must be retained to support expenditures. Each receipt should include the date, place, personentertained, type of entertainment, business purpose, and business relationship. No receipts are necessarily required forentertainmentexpenses under $75 per expense. - Time and Date: The time and date

when the entertainment takes place. When entries are made in a diary-type document, the date on the diary page is adequate support for time. - Place and Description: The nature and place of the

entertainment(“business meal at Ruby Tuesdays”) must be described. When a charge slip or receipt is obtained, the nature and place are usually self-evident and the additional necessary items can be hand written on it at the time of receipt. - Business purpose: Of the six elements, this is the most important.

A specific advanced purpose for the entertainment is required.You must have a specific business purpose to meet with your prospect in order to deductany entertainment withthem. The following examples will illustrate this:- ○ Example: Bill goes to a local steakhouse alone for dinner. He strikes up a conversation with the waitress about his real estate business. His dinner would not be deductible since he didn’t have a prearranged appointment to meet with her.

- ○ Example: Bill is talking with his next door neighbor, Sally. She mentions that she is considering selling her house but doesn’t have time to talk about it at that moment. Instead she suggests that Bill come to the restaurant where she works for lunch as a waitress and talk about listing her home over lunch. This meal

wouldmay be deductible.

- Business relationship: The IRS wants you to identify the person or persons

entertained. The names, occupations, official titles, and other corroborative information to establish the business relationship should be identified. In many cases, the person’s name with the word “prospect” would be sufficient to establish both business purpose and business relationship for a business meal. - Timely Recording: The recording must be contemporaneous with the activity. For all practical purposes, that means you must record the elements of substantiation on a timely basis, preferably on the day

the entertainment takes place.

Deducting Business Meals

The following are generally required in order to support a tax deduction:

- You must discuss business before, during, or after a business meal to qualify for a business meal deduction.

- The business meal must be arranged for the purpose of conducting specific business before the fact.

- The business meal must take place in surroundings conducive to a business discussion. IRS presumes that the “active business discussion” test is not met if the business meal occurs under circumstances where there is little or no possibility of engaging in a business discussion. Eating dinner at a nightclub with a continuous floorshow is an example of a non-business setting. Similarly, a large cocktail party is not a business setting.

Documentation of a Business Meal: Answering the questions “Who?”, “Where?”, “When?” and “Why?” and recording the cost is necessary documentation for business meals. see IRC §274(d)(3)

Deducting Associated Entertainment Expenses

You generally may not discuss business in places and at events that are not business settings. Examples of non-business settings include, for example:

NightclubsGolf coursesTheatersSports eventsHunting tripsFishing tripsSki trips

By themselves, entertainment expenses for activities like those above are not deductible. However, they can be deducted under the “associated entertainment” rule. Associated entertainment, also called goodwill entertainment, takes place in a non-business setting. No business discussion must occur during the entertainment. The entertainment precedes or follows a substantial and bona fide business discussion, usually the same day as the entertainment. The key to deducting associated entertainment is linking it to a related business discussion.

Documentation of a Business Meal Followed by a nearby Theater Performance

The theater event is linked to the meal because it preceded the entertainment event. The documentation should show that business discussion occurred in a proper business setting and was followed by entertainment “associated” with the meal and discussion.

Season Tickets to Events: Season tickets and box seats to theaters and sports events are treated according to the individual events. For example, you hold season theater tickets to attend 10 specific performances during the year. You treat each of the 10 performances separately.

The deduction is limited to the printed face value of the ticket, generally you cannot deduct more even if you paid a higher price for service fees paid to ticket agencies or brokers or any amount over the face value of the tickets that was paid to ticket scalpers.

Business Gifts: Tax law limits your maximum deduction to $25 for business gifts to any one person during a tax year. (See page 15 of Pub. Law 87-834, Sec 274(b), a/k/a Revenue Act of 1962 effective for years after December 31, 1962, and which is still in effect today). This limitation applies to gifts of tangible personal property. Spouses are treated as one taxpayer for purposes of gift giving (in effect a limit of $12.50 gift for each spouse). However, gifts made to a business where there is no single person designated to receive or benefit from the gift, have no limit – such as a $300 kitchen microwave unit or a $200 fruit basket sent to a customer’s business office.

There is an alternate rule for gifts of entertainment event tickets. You have the choice of treating the gift of a theater ticket either as entertainment or as a business gift. There’s no $25 limit on the gift of an entertainment event ticket when you are present at the event and have an associated substantial business discussion before, during or after the event. Otherwise, when giving entertainment event tickets away as gifts the deduction is limited to $25, but you need not go along to the event.

The IRS offers this “break:” Not included in the $25 limitation are items costing less than $4 and has your name clearly and permanently imprinted on the gift, and is one of a number of identical items you widely distribute (examples include pens, desk sets, and plastic bags, and cases). Also the reasonable cost without limit for signs, display racks, or other promotional material to be used on the business premises of the recipient.

Substantiation required: IRC §274(d) Description of gift, date of gift, amount paid, business relationship & business purpose.

Expenditures that are deemed to be gifts: Regs §1.274-2(b)(1)(iii) Such as packaged food to be eaten elsewhere unaccompanied by taxpayer.or tickets to entertainment unaccompanied by taxpayer.

Gifts to an employee

A gift/loan to family member is considered personal, but it is a rebuttable presumption and may be overcome with great care and attention to details and actions.

A gift/loan to employee is compensation, but it is a rebuttable presumption and may be overcome with great care and attention to details and actions.

Inter Vivos Transfers to an Employee

In adopting IRC §102(c), Congress intended to prevent gift treatment for employee awards regardless of whether the Duberstein standard could be met. If such an award is to be excluded, it will have to fit under some other statutory provision. But what about transfers to an employee that do not constitute awards? The unrestricted language of the statute denies gift treatment to any transfer from an employer to, or for the benefit of, an employee. It is reasonably clear, however, that notwithstanding that language, Congress did not intend to prevent gift treatment for all such transfers. The House Report

on the 1986 Act states, [o]f course, gifts between individuals made exclusively for personal reasons (such as birthday presents) that are wholly unrelated to an employment relationship are not includible in the recipient’s gross income merely because the gift-giver is the employer of the recipient. A transfer between personal acquaintances will not be considered to have been made exclusively for personal reasons if reflecting any employment-related reason (e.g., gratitude for

services rendered) or any anticipation of business benefit.

In addition to this statement in the House Report, a proposed regulation was promulgated on January 9, 1989, adopting a similar construction of section 102(c). The proposed regulation states:

[f]or purposes of section 102(c), [Reg §1.102-1(f)(2) ] extraordinary transfers to the natural objects of an employer’s bounty will not be considered transfers to, or for the benefit of, an employee if the employee can show that the transfer was not made in recognition of the employee’s employment. Accordingly, §102(c) shall not apply to amounts transferred between related parties (e.g., father and son) if the purpose of the transfer can be substantially attributed to the familiar relationship of the parties and not to the circumstances of their employment.

The Taxation of a Gift or Inheritance from an Employer.

Meals are not entertainment: Gifts of entertainment meals are not allowed. You are entitled to a tax deduction for a business meal only if you are present during the consumption process.

Meals and entertainment with your spouse: The IRS has a “closely connected” rule. Most spouses qualify as closely connected. The closely connected rule permits deducting the expenses of entertaining your spouse as well as the spouse of a business guest. In other words, if your business guest brings a spouse, you are entitled to bring yours. Of course, you must be entertaining the business guest during the ordinary and necessary course of your business and you must meet the business discussion and documentation requirements.

Deducting Dutch-treat Meals: When you go to a meal with a business guest, pay your own way and spend more than what you would normally spend, the Dutch-treat rule comes into play. For example, you attend a Chamber of Commerce luncheon meeting and the lunch costs more than you would normally spend for lunch; you may claim the excess as a Dutch-treat business lunch.

Example: You spend $22 at a Chamber luncheon. Had you not gone to the luncheon, you would have spent $2. Your deduction is $10, the excess business cost over your personal cost (times 50%).

The “Sutter Rule”

IRS may, at its discretion, invoke the “Sutter Rule” Richard A Sutter v. Comr 21 T.C. 170 (1953). The “Sutter Rule” allows IRS to disallow a portion of your business meals when such meals absorb substantial amounts of your typical living expenses.

Document personal meal costs to support your Dutch-treat meals and avoid the “Sutter Rule.”

- Written evidence: Your personal meal evidence must be in writing. Entries in your diary or account book are strong evidence.

- 30-Day test: Record the cost of personal meals in your diary. Do this for at least 30 days during the year.

- Meals at home: When you eat meals at home, the task of developing your personal meal costs is somewhat more complicated. There are basically two ways to compute the cost of personal meals consumed at home.

Method 1: Write down the actual items consumed and determine the cost of each item. Two eggs for breakfast, when a dozen eggs cost $1.20, would cost $0.20. If you need to determine actual costs only a few times during the year, it’s easy to simply write down the actual items consumed.

Method 2: Use actual grocery bills to make an allocation by members of the family. If, for example, the grocery bill for a week amounts to $150, you can estimate the cost for breakfast, lunch, and dinner. If the dinner groceries cost $70, you could divide the $70 by seven days in a week to arrive at $10 for the average dinner. If there are two people in your family, the average cost per person is $5. That would be your cost for purposes of determining your Dutch-treat deductions and maximum disallowance under the Sutter Rule.

Deducting Home Entertainment Business Expenses

Your home is already a setting conducive to a business discussion. If you invite a couple to your home for dinner, it’s easy to have a one-on-one business conversation. You do not need to spend more time trying to conduct business than you spend entertaining your guest.

Example: You invite the Jones to your home to ask for a referral. You ask for and receive the referral. Even though 90% of the evening is spent on non-business activities, the cost is deductible. If you asked for and failed to get a referral, the cost of entertainment is still deductible.

Your home entertainment deductions are more secure when you discuss specific business with your guests. Keep your guest list small; fewer than 12 people. That way you can talk to everyone with whom you need to discuss business.

When you invite more than 12 people to your home, you will be hard pressed to prove to IRS that you had specific business discussions with everyone in attendance. Therefore, you must establish some other type of commercial motivation.

If you entertain a group for the purpose of showing a display of your business products or services, commercial motivation is generally clearly established. When you combine the display of products with an invitation that invites the guests for a specific business reason, you strengthen your case for deductibility.

Example: Jorge built his own office building and is looking for tenants. He throws a party for friends who might be desirable tenants. This party would qualify as a deductible business entertainment expense if it meets three both of two tests:

- It is not “entertainment.”

- Clear showing of commercial motivation.

Jorge’s invitation established the introduction of the new office building as the reason for the party. In the room where the party was held, Jorge had photographs of the new building posted on a bulletin board. Although none of the individuals attending the party rented space in the new building, Jorge clearly established a clear business motivation for the party.

- Meet five elements of substantiation.

1. Cost: Jorge has receipts and cancelled checks.

2. Time: Date at top of diary page.

3. Description: Entry in diary.

4. Business purpose: Entry in diary plus invitations and photographs of people around the bulletin board.

5. Business relationships: Names of individuals who own their own businesses and are prospective tenants.

The expenses are deductible because Jorge passes both tests.

Personal Celebrations: Never, never combine a personal event with a business entertainment event. A birthday party for your 10-year-old with business guests in attendance will not fly with IRS. Home entertainment costs, especially when large groups are involved, is deductible only when you can firmly establish a business purpose. If you have no personal or social relationships with the guests, other than business, your chances for a deduction are improved.

Fully Deducting Employee Meals and Entertainment (IRC §119) (50% Deductible after 2017)

You may deduct the costs to provide lunches to employees on a tax-free basis if you provide lunch for over one-half of the employees, and

- there is a short lunch period (generally no more than 45 minutes) or

- they are available for emergencies (such as an ambulance service) or

- there are insufficient eating facilities nearby.

Also, meals must be furnished on normal business days. See Boyd Gaming v. Comr

Also, the taxpayer should enforce its own substantiated policies (including the value of said meals) and whether those policies qualify as “substantial noncompensatory business reason” for furnishing meals. See TAM 201903017

The reasonable cost of a year-end holiday party or a summer outing for employees and their families also is 100% deductible. Holiday Office Party Deductions: 4 Rules, 100% Deduction

Also see Meals and Entertainment Change Under 2018 Tax Reform

Also see IRC §274(e)(1)

Also see “The High Cost of a Free Lunch”

Also see “IRS TAM 201903017”

Secs. 132(a), 119(a), 3121(a)(19) and (20), 3231(e)(5) and (9), 3306(b)(14) and (16), and 3401(a)(19).

Sec. 132(e)(1). Examples include occasional personal use of an employer’s copying machine, occasional parties or meals for employees and their guests, local telephone calls, and coffee, doughnuts and soft drinks. Treas. Reg. sec. 1.132-6(e)(1)

50% deductible for meals furnished after 2017

There are several other exceptions to the 50% limitation rule:

- Reimbursed expenses – the self-employed independent contractor

- Reimbursed expenses – employee (§274(e)(3))

- The “HoneyBaked” Ham – de minimis (§274(n)(2)(B))

- The company party (§274(e)(4))

- Items available to public (§274(e)(7); LTR 94140040; LTR9641005)

- Items sold to customers (§274(e)(8))

- Charitable fund raising (§274(n)(2)(c))

- Employer’s reimbursement of employee meals considered moving expenses (§274(n)(2)(D))

- Expenses for food or beverages required by any Federal law to be provided to crew members of commercial vessels or expenses for food or beverages provided to crew members of a commercial vessel that is operating on the Great Lakes, the Saint Lawrence Seaway, or any inland waterway of the United States and which would be required by Federal law to provide food and beverage if the commercial vessels were operated at sea (§274(n)(2)(E)(i & ii))

- Expenses for food or beverages provided at certain oil or gas platforms or drilling rigs and support camps (§274(n)(2)(E)

Business Club Dues and Lunches: You can deduct dues paid to business clubs when such payment is in the ordinary and necessary course of business. The terms “ordinary” and “necessary” mean that the expenses are customary, usual or normal, and helpful or appropriate. Dues to your local Chamber of Commerce would almost always be appropriate and normal. Dues paid to professional societies are deductible. Trade association dues are deductible if the association’s purpose is the furthering of the business interests of its members. Dues for community clubs organized to attract tourists and new members to your locality give rise to deductible dues.

Social club and country club dues: Initiation fees and ongoing monthly dues generally are not deductible.

Note: This limitation only applies to the initiation fees and dues. A portion of the cost attributable to meals, while talking business at a social club or a country club, may otherwise be deductible.

Give sales seminars and presentations at home: The tax court has ruled that all food and refreshments served to prospects are 100% deductible if provided at home during a sales seminar or sales presentation.

Business Expense vs. Business Promotion: IRS uses an objective test to determine whether an activity is of a type to constitute entertainment (which is 50% deductible) or is more like business promotion (which is 100% deductible). Thus, attending a movie or theatrical performance would normally be considered entertainment. However, it would be deemed promotional if done so by professional theater critics or movie critics. Similarly, a golf club salesman who plays golf and demonstrates his clubs and other golfing equipment should be able to deduct 100% of his green fees and costs of his golf balls, caddie expense, etc.

Business Entertainment Summary

Discuss business when you eat.Link “associated entertainment” expenses to a business meal.Treat season tickets on an individual event basis.Use entertainment event tickets as business gifts to avoid $25 ceiling.Feed and entertain your spouse.Deduct the excess for Dutch-treat meals.○ By sure to document personal meal costs to support your Dutch-treat meals and avoid the “Sutter Rule.”

Deduct home entertainment.Give small parties at home.Properly set up and document large group entertainment to solidify deductions.Entertain and feed your employees.Deduct business club dues and lunches.Give sales seminars and presentations at home.Deduct all food at sales presentations.

Examples of Meals and Entertainment and other Expenses

Fully 100% deductible

- Gifts valued up to $25 per person, per calendar year.

- Meals provided for the employer’s convenience, obtained and consumed on the job site.

- Water cooler, coffee and snacks provided on the job site.

- Promotional events made available generally to employees, customers or other visitors who are present.

- Holiday party for employees or customers.

- Payment for charitable events that is in excess of the fair stated value of any related entertainment, goods and services received and consumed. (subject to the typical charity limitations).

- Reasonable travel associated with any of the above as well as going to a business meeting, when leaving from a previous job site or business location. (such as going to a restaurant, office holiday party, discussions at a location

with associated entertainment). - During 2021 & 2022 those 50% meals are now fully deductible to help restaurants recover from COVID19 setbacks.

80% deductible

- Truckers for their meals on the road overnight.

- Pilots for their meals while away from home overnight.

50% deductible

- A meal with a customer, employee, etc.

with a substantial business discussionunder circumstances generally considered conductive to a business discussion. - Cost for an

entertainmentevent where you accompany the customer, employee, etc. and have a substantial business discussion or other business purpose such as being attended under circumstances generally considered conductive to a business discussion – the surroundings should be such that there are no substantial distractions to the possible business discussion. - A meal alone when away from home overnight on business travel.

- The related taxes and tips.

non-deductible

- Gifts valued in excess of $25 per person, per calendar year.

- A meal with a customer, employee, etc. without having a substantial business discussion.

- A normal reasonably priced meal with a customer or employee, etc. with a business discussion, but paying Dutch treat.

- ○ To avoid this tax trap, sometimes two people will “take turns” by picking up the whole cost of every other meal.

- Cost for an

entertainmentevent, where you do not accompany the customer, employee, etc. - Social club and country club dues, etc.

- Cruise trips out of the USA (subject to exceptions).

- Travel to a business meeting, leaving from your home or back going to your home (if there’s no home office where work needs to be addressed, or other intermediary business stops along the way).

Possible rules starting with 2018 (all subject to clarification or change), from the website of Mark J. Kohler, M.Pr.A., C.P.A., J.D.

* Technically, the TCJA made meals with clients and prospects non-deductible. We expect the IRS to provide Regs that meals ‘not tied to an entertainment experience’ and truly non-entertainment meals to still be deductible. We don’t know when this change/guidance will come but track your meals separate from entertainment in the meantime as if they are still deductible.

** Employees are defined as non-owners,/officers/directors, or non-highly compensated employees. For example, the majority of those attending a year-end party, team building activity, or eating the in-office food, must be employees as defined in the preceding sentence.

Writing Off Dining and Food Expenses in 2018 – Master Chart of Options