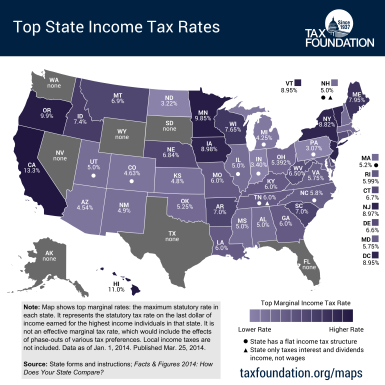

Tax-Free States

When fleeing a high-tax state for one with lower or no income taxes, be wary. Your former high-tax state may be watching to see if you really do qualify as a resident of the low-tax state or if you are just claiming that you do in order to avoid paying a higher tax bill. Tax examiners check ATM and credit card receipts, highway toll charges, gasoline service station receipts, airline fares and similar for evidence that taxpayers spent over 182 days in the higher tax state, making them tax residents. Tax examiners also check voting records, country club memberships, legal documents, automobile registrations, pet cemeteries and more.

Alaska*

Delaware* (has no income tax filing requirement on domestic entities located solely out of the state)

Florida

Nevada

New Hampshire* (non-business income tax on dividends and interest income only)

South Dakota

Tennessee (non-business income tax on dividends and interest income only, to be phased out by 2022)

Texas

Washington

Wyoming

* No Sales Tax on purchases made in-state, as well as these three states:

Montana

Oregon

Hawaii

Retirees, these states do not tax distributions from 401(k) plans, IRAs or pensions”

Illinois

Mississippi

Pennsylvania

These states do not tax distributions from pensions, but they do tax distributions from 401(k) plans and IRAs:

Alabama

Hawaii

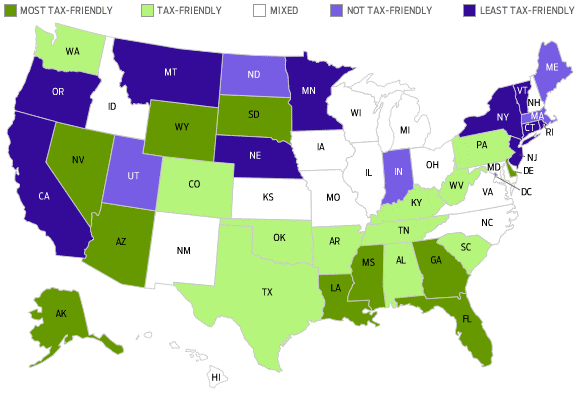

State-by-State Guide to Taxes on Retirees